By Liz Belcher, CPA

By Liz Belcher, CPA

Senior Manager, Tax Services

[email protected]

As part of the Tax Cuts and Jobs Act, Congress created an incentive for new long-term investments in economically distressed areas. Established as Opportunity Zones, these areas are designed to boost economic development and job growth in struggling communities by providing tax benefits to investors. Opportunity Zones have been designated by census tracts and were selected by each state’s governor. (Click here for a complete list of qualified Opportunity Zones throughout the country.)

Eligible investors include businesses and individuals with realized capital gains. Unlike 1031 exchanges, which only allow deferral on real property transactions, Opportunity Zone investments allow investors the ability to defer tax on almost any capital gain until the earlier of the date on which the investment in a Qualified Opportunity Fund (QOF) is sold, or Dec. 31, 2026. This applies to any gain realized after December 22, 2017 in which the proceeds (or a portion of the proceeds) are properly invested within 180 days. The types of gains that may be deferred include actual or deemed, sale or exchange and any other gain that is required to be included in the computation of capital gain.

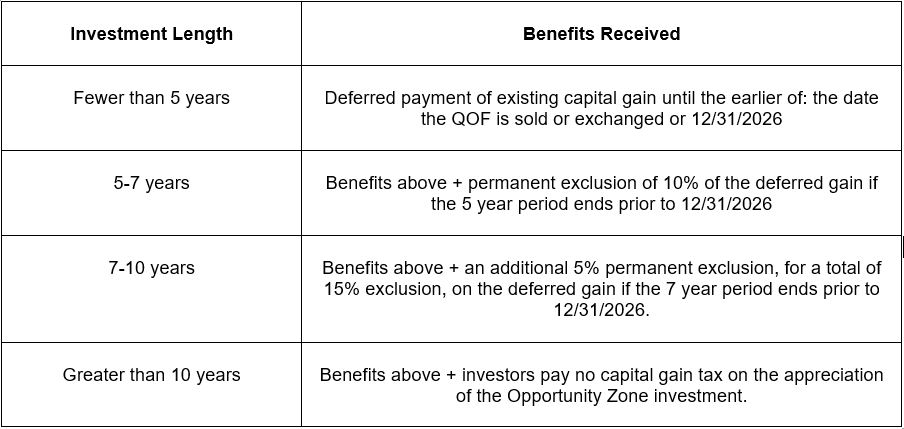

Beyond tax deferral, QOF investments may also be eligible for permanent tax exclusion, a highly-desired, but rarely-offered benefit. If the QOF investment is held for longer than 5 years, there is a potential 10% exclusion of the deferred gain. If held for more than 7 years, the 10% becomes 15%. Second, if the investor holds the investment in the QOF for at least ten years, the investor is eligible for an increase in the basis of the QOF investment equal to its fair market value on the date that the QOF investment is sold or exchanged.

To qualify for deferral and potential exclusion, the capital gain must be invested in a Qualified Opportunity Fund — any investment vehicle organized as a corporation or partnership for the purpose of investing in a qualified Opportunity Zone property. The QOF must hold at least 90 percent of its assets in this property and report to the IRS annually to ensure eligibility is maintained. There are a number of private real estate investment firms accepting investments through eligible QOFs, or an investor may choose to create a new fund meeting the QOF standards.

Investments in Opportunity Zones are intended to be long-term in nature. Listed below is a breakdown of tax benefits based on the length of time invested in Opportunity Zones.

For more information on Opportunity Zone regulations and benefits, visit the Tax Reform page on the IRS website.

If we can assist you further with achieving success in your business or personal affairs, please call Liz Belcher at (317) 613-7846 or email her at [email protected].