By Jason S. Thompson, CPA/ABV, ASA, CFE, CFF

By Jason S. Thompson, CPA/ABV, ASA, CFE, CFF

Partner, Director of Valuation & Litigation Services

Email Jason

~and~

Christopher Sargent, CPA/ABV, AM

Senior Analyst, Valuation & Litigation Services

Email Chris

On October 17, 2023, the Indiana Supreme Court issued an order amending the state’s Child Support Rules and Guidelines. These amended rules and guidelines will go into effect on January 1, 2024. While these amendments ultimately impact the amount of child support an individual may pay/receive, they have little impact on the current guidance regarding the determination of Weekly Gross Income, a driver for determining Weekly Support Payments.

Within the various amendments is a discussion around the use of new economic data. This discussion introduces the “Rothbarth” approach, which is based on the assumption that the amount of spending on children can be inferred by examining how parents reduce spending on themselves as the number of children in the family increases. The approach uses the data of Consumer Expenditure Surveys from 2013 to 2019 as support for its findings. The approach was considered a more accurate reflection of direct estimates of child spending levels than used in the existing rules and guidelines.

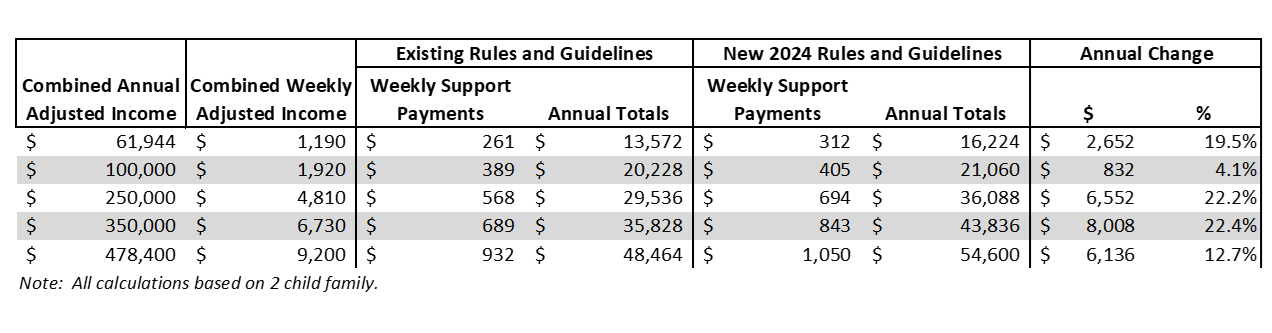

This data on the spending by intact families on children prompted changes to the Weekly Support schedule. The table below highlights the impact of these changes on varying levels of combined Weekly Adjusted Income:

The table indicates an increase of $51 ($312 – $261) in the Weekly Support Payment of a mother and father with combined weekly income of $1,190 [1]. This weekly increase equates to an annual increase in support of $2,652. For divorcing couples at the high end of combined weekly income levels ($9,200 being the maximum amount included in the Weekly Support schedule), the annual dollar increase is more significant, $6,136. In general, the new 2024 rules and guidelines’ Weekly Support schedule indicates increases in amounts for Weekly Support Payments across most combined weekly income levels [2].

If we can be of assistance in determining income available for child support or any other financial analysis for you or one of your clients, please call us at (317) 608-6699 or email Jason or Chris.

1. This amount is representative of an annual combined income of $61,944, Indiana’s median household income as reported by the U.S. Census Bureau for 2021.

2. The Weekly Support Payment increases in the new 2024 rules and guidelines begin at a combined Weekly Adjusted income of $590 (annual amount of $30,680) for a single child family. Below $590 of combined Weekly Adjusted income, the Weekly Support Payment decreases in the new 2024 rules and guidelines. The impact of the new 2024 guidelines on the Weekly Support Payment amount differs based on combined weekly income and the number of children.